massachusetts estate tax table 2021

The graduated tax rates are capped at 16. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe.

Estate Tax Rates Forms For 2022 State By State Table

Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married.

. A state sales tax. Up to 25 cash back The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022. A local option for cities or towns.

Real estate taxes are billed on a fiscal-year basis. Ad Complete Tax Forms Online or Print Official Tax Documents. Massachusetts Estate Tax Rates.

2 How Do State Estate And Inheritance Taxes Work Tax Policy Center Massachusetts Tax Rates Rankings Ma. You skipped the table of contents section. Ad Cross New Borders With Confidence.

So even if your. 1 to buyer 1 to seller. Massachusetts estate tax exemption 2021.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. A state excise tax. For 2021 Schedule E-3.

Clients In 50 Countries. Masuzi May 14 2014 Uncategorized Leave a comment 25 Views. Make The World Your Marketplace With Aprios Intl Tax Planning Services.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The fiscal year begins on July 1 and runs through June. Massachusetts estate tax table 2021 Monday February 14 2022 Edit.

We Can Help You Plan for the Future of Your Loved Ones. Ad Massachusetts Estate Planning Law Firm Specializing in Wills Trusts and Estates. Massachusetts income tax rate and number.

Massachusetts Resident Income Tax Return. Extendable round table 2022. 402800 55200 5500000-504000046000012 Tax of 458000.

Download Or Email M-706 More Fillable Forms Register and Subscribe Now. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. Example - 5500000 Taxable Estate - Tax Calc.

Massachusetts NonresidentPart-Year Tax Return PDF 26786 KB Open PDF file 174. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. As of 2021 the federal threshold for paying estate taxes for 117 million for single individuals or unmarried couples and 234 million for married people.

Massachusetts estate tax table 2021 Monday July 25 2022 Edit. Download Or Email M-706 More Fillable Forms Register and Subscribe Now. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal.

Home Massachusetts Tax Table. Estate Trust REMIC and Farm Income and Loss.

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Income Tax H R Block

Massachusetts Tax Relief Senate Unveils Changes To Estate Tax Plus Child Care Credit And Rental Deduction Cap Among Other Cuts Masslive Com

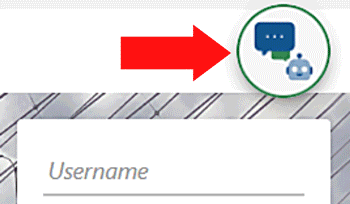

Masstaxconnect Resources Mass Gov

Sports Betting But No Tax Breaks Where State Lawmakers Did And Didn T Reach Deals

Estate Tax Asset Management Gifts And Gift Taxes Estate Planning

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Massachusetts Estate And Gift Taxes Explained Wealth Management

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Legislative News Massachusetts Society Of Cpas

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

A Guide To The Federal Estate Tax For 2021 Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Where Not To Die In 2022 The Greediest Death Tax States

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust